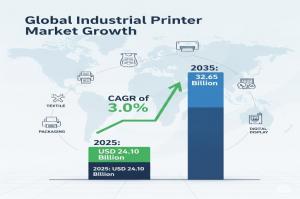

Industrial Printer Market to Reach USD 32.65 Billion by 2035, Driven by Packaging, Automotive & Electronics Growth

The industrial printer market is growing steadily, driven by demand in packaging, automotive, textiles, and electronics for accurate, efficient printing.

NEWARK, DE, UNITED STATES, August 22, 2025 /EINPresswire.com/ -- The global industrial printer market is set to experience sustained growth, projected to expand from USD 24.10 billion in 2025 to USD 32.65 billion by 2035. This growth reflects a CAGR of 3.0%, driven by rising demand across industries such as packaging, automotive, textiles, and electronics. Industrial printing continues to play a pivotal role in ensuring accurate labeling, coding, and branding—factors critical to regulatory compliance and consumer trust.

Industrial printers, including inkjet, laser, and thermal transfer systems, have evolved into indispensable production line tools. Their efficiency, accuracy, and integration with digital ecosystems enable manufacturers to achieve higher throughput while reducing waste. As the manufacturing sector embraces smart factory initiatives, industrial printers are being increasingly integrated with IoT, cloud systems, and AI-based monitoring, ensuring real-time performance optimization.

Explore Opportunities – Get Your Sample of Our Industry Overview Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-18290

Showcasing Innovation: Established Giants and Emerging Players

The industrial printer industry will witness a surge of innovations in 2025, with both global leaders and dynamic emerging companies showcasing cutting-edge solutions.

Tier 1 leaders such as HP Inc., Canon Inc., Fujifilm Holdings, Xerox Corp, and Heidelberger Druckmaschinen AG continue to push boundaries with high-volume, eco-friendly, and smart-enabled printers. HP, for instance, recently introduced its HP Color LaserJet 3000 series, aligning with its long-term strategy of offering printers-as-a-service.

Meanwhile, mid-sized Tier 2 innovators such as Seiko Epson Corporation, Eastman Kodak, and Konica Minolta are bridging the gap between traditional analog and digital hybrid solutions. Epson’s release of new inkjet printheads supporting solvent inks highlights ongoing advancements in substrate versatility.

Tier 3 and start-up companies are also stepping into the spotlight, catering to niche applications and local demands. From specialized textile printers to compact, cost-effective marking systems, these new entrants are shaping a competitive and diverse marketplace.

Driving Forces Behind Growth

The global rise of e-commerce and packaged goods has created a surge in demand for reliable, high-volume printers capable of handling diverse labeling and branding requirements. Coupled with advancements in ink delivery systems and print heads, industrial printers are becoming faster, more durable, and more cost-efficient.

Infrastructure expansion is another catalyst. As governments worldwide boost investments in roads, buildings, and public amenities, demand for printed signage, blueprints, and large-format graphics has escalated. In India, a 10% YoY increase in capital outlay for infrastructure is already fueling packaging and industrial printing adoption.

At the same time, sustainability trends and government regulations are shaping the market landscape. Low-VOC inks, waste management standards, and eco-friendly printing technologies are now industry imperatives. Manufacturers that innovate in green printing technologies will likely lead the next wave of adoption.

Regional Insights: North America, Europe, and Asia-Pacific Lead the Way

North America and Europe maintain strong positions due to mature industrial sectors and stringent regulations on product safety and labeling. The USA, with a projected CAGR of 2.3%, is seeing growth in industrial printers for out-of-home (OOH) advertising, as brands push for high-quality, large-format, and durable signage. The Out of Home Advertising Association of America reported a 7% YoY rise in OOH printed media in early 2025.

Asia-Pacific, however, is the region to watch. With China projected at 4.0% CAGR and India at 4.9%, the region is becoming the hub of industrial printer adoption. India’s packaging sector, boosted by e-commerce, organized retail, and export-focused policies, is driving demand for efficient and customized printing solutions. Similarly, China’s expanding electronics and automotive industries are fueling the adoption of advanced printing technologies.

Market Dynamics: Opportunities and Challenges

Offset lithography continues to dominate industrial printing technology, with a projected 48.7% market share by 2035. Its balance of cost-effectiveness and superior image quality keeps it relevant, despite the rapid rise of digital printing. Analog printers, including flexographic and gravure systems, still hold 71.8% market share due to their reliability in high-volume applications.

On the opportunity front, rapid advancements in ink and print head technologies are unlocking new applications, from textiles to specialty packaging. However, challenges remain. The complexity and high maintenance of advanced systems could hinder adoption among SMEs.

Trade and Regulatory Landscape

International trade continues to shape the industrial printer market. Japan, Germany, China, and the USA remain top exporters, while regions like Asia-Pacific and Europe are major importers of advanced printing technologies. Cross-border collaborations are increasingly common, with global companies partnering with regional firms to expand their footprints.

Regulatory frameworks are evolving in parallel. From emissions standards set by the EPA and EEA to waste management mandates like WEEE in Europe, compliance is becoming a non-negotiable aspect of product development. Printers that meet environmental and safety certifications such as CE, UL, and ISO 12100 are gaining wider acceptance.

Find Out More—Read the Complete Report for Full Insights!

https://www.futuremarketinsights.com/reports/industrial-printer-market

Key Players and Developments in Focus

Recent product launches reflect the market’s dynamism:

• Sturdy Print leveraged SCREEN’s inkjet technology to deliver high-end labels (June 2024).

• Domino Printing Sciences launched a thermal inkjet solution for food packaging (June 2024).

• FUJIFILM unveiled Jet Press FP790 for flexible packaging (March 2024).

• Komori Corporation launched the J-throne 29, the fastest B2+ size inkjet press (March 2024).

• Agfa introduced SpeedSet 1060 for packaging applications (December 2023).

• Epson and Mimaki continue to pioneer innovations in textiles and soft signage printing.

Related Insights from Future Market Insights (FMI)

Industrial Printer Market Share Analysis - https://www.futuremarketinsights.com/reports/industrial-printer-market-share-analysis

Printer Ribbon Market - https://www.futuremarketinsights.com/reports/printer-ribbon-market

NCR Printers Market - https://www.futuremarketinsights.com/reports/ncr-printers-market

Industrial Paper Sacks Market - https://www.futuremarketinsights.com/reports/industrial-paper-sacks-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.